cryptocurrency accountant melbourne

Our qualified Australian cryptocurrency accountants help with clients. Crypto Tax Australia provides tailored and proactive Cryptocurrency Taxation advice to its clients whether you are an investor or trader anywhere throughout Australia.

Cryptocurrency Fraud Guide For Australian Investors Sewell Kettle

Weve put a together detailed guide of cryptocurrency tax in Australia breaking down cryptocurrency tax for businesses in Australia as well as crypto tax for everyday traders or hobbyists and crypto tax for.

. We have two simple goals at Munros. Superfund warehouse is Melbourne based firm servicing clients Australia-wide which provide SMSF accountant SMSF tax return and Self Managed Super Fund administration services. All of our accounting work is done in Australia by Qualified experienced.

08 9427 5200 Contact Us Now. SMSF Accounting Service in melbourne. We provide professional and tailored Crypto currency tax advise and bookkeeping service to crypto currency investors traders miners and businesses who accepting crypto currency as payment.

When an SMSF acquires and disposes of cryptocurrency it faces. Non-fungible tokens or NFTs fungible means interchangeable are one. Crypto Tax Plus provides online personalised accurate and practical crypto related tax services to investors trader and enthusiasts alike.

Getting cryptocurrency tax right can be difficult but that why you get a cryptocurrency accountant to manage your tax situation. We have been helping SMSF trustees SMSF accountants financial planners and SMSF administrators with an efficient timely and cost effective SMSF administration services. Veronique is the principal of TAH who has over 10 years of accounting and taxation experience.

16 tips for managing your small business finances. Asides from compliance we also run regular tax workshops the popular Meetup group Crypto Entrepreneurs. Based in Melbourne servicing clients Australia wide.

The ATO have recently released guidance for self-managed superannuation funds SMSFs investing in cryptocurrencies. Passionately work every day on every project to reduce tax as much as legally possible -. As a result of that I assume the ATO now has a a lot better understanding of whos involved on this market.

A self-managed super fund SMSF is a type of retirement savings plan. Cryptocurrency Tax Accountants and Advisors. Our Cryptocurrency Accountants work with all types of Crypto.

We specialise in all types of crypto from the large market cap currencies BTC ETH XRP right through to the lesser known altcoins. It is unlike the unsolicited tax advisory institute you can find randomly. We are Australias GO-TO Cryptocurrency Tax Accountants and it will be our pleasure for you to use our service and benefit from our unique systems and knowledge.

Read more about Cryptocurrency Accountant Melbourne here. We provide accounting tax and advisory services for small- to medium-sized enterprises and high-net-worth individuals worldwide. Fullstack Advisory is your trusted source for expert crypto tax preparation and up to date tax knowledge.

Speak to the Cryptocurrency accountants in Melbourne now. TAH is recognised as one of the highly-rated tax accountants in Melbourne. With some guidelines provided by the Australian Taxation Office you wont be subject to.

Cryptocurrency tax reports are our specialty and best of all. Cryptocurrency Accountants or Munros Cryptocurrency Accountants is a seasoned 45 years old accounting firm that provides tax and business advisory in the state of Australia. She is a Certified Tax Agent by the Tax Practitioners Board and the ATO.

The experts behind this platform know the core of business and tax. An individual using a cryptocurrency is defined as someone who originally purchased the cryptocurrency as a way to buy goods and services for their own personal consumption. Our expertise could help you to find the best tax structure as a vehicle to carry the crypto.

LODGEMENT DEADLINE 31 OCTOBER 2021. Theyre like an investment decision for your future. Find a cryptocurrency tax accountant or tax agent in Australia.

Help demystify cryptocurrency taxation in Australia so you can make more informed decisions. Tax Accounting House is your one-stop-shop tax accountant in Melbourne. Cryptocurrency Taxation Accounting Services The beginning of a new frontier In the ever-growing digital world we are continually being asked questions regarding the tax implications of investing trading and mining in Cryptocurrency and Non-Fungible Tokens NFTs.

Contact us to ensure you are prepared for tax time and have the right strategy put in place. To invest in crytocurrencies the investment must be allowed under the SMSF trust deed and be in accordance with the investment strategy. Most folks hold shares long term for dividends rather than crypto the place there may be solely capital progress available.

Valles Accountants is a boutique accounting firm conveniently based in the Melbourne CBD. Our team of professional tax accountants lead by Greg Valles brings more than 35 years of collective experience. Posted on March 21 2018.

Heres where you can book a PCR test in Melbourne and wider Victoria. Were determined to help small businesses successful and maximise individuals tax refunds. Submit the afore-mentioned information today to obtain your tailored quote.

But cryptocurrency is only one part of the blockchain universe. Nobel Thomas Melbourne business accountants is the premier full-service accounting firm providing accounting payroll processing financial analysis and tax services to businesses in a variety of industries. Tax Accounting House TAH is a team of Melbourne accountant and personal tax agent.

Cryptocurrency tax returns generally start from 2500. Annual Fee 890 more info.

Crypto Tax Returns Cryptocurrency Accountants Accountants Business Advisors Aspley

Crypto Tax Tips Australia 2021 Crypto Tax Accountant Q A Youtube

Find A Qualified Cryptocurrency Tax Agent In Australia Finder Com Au

Today S Cryptocurrency Data Aggregators Offer A Plethora Of Onchain And Market Insights Jackofalltechs Com

Sydney Crypto Accountant Recommendations R Bitcoinaus

Australian Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Accounting Services Cryptocurrency Accountant Melbourne Crypto Tax Melbourne Numbers Talk

Cryptocurrency Accountant Why You Need One Fullstack

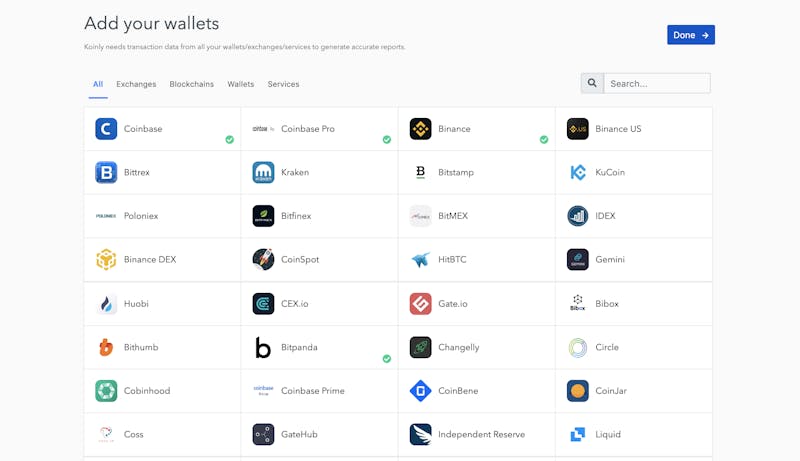

Koinly Crypto Tax Calculator For Australia Nz

Tax Tips On Bitcoin Crypto In Australia 2021 Specialist Cryptocurrency Tax Accountant Q A Youtube

Episode 16 Everything You Need To Know About Australian Crypto Tax With Adrian Forza Youtube

How To Find A Crypto Accountant Tokentax

Cryptocurrency Tax Adelaide Fab Tax Accountants

Crypto Tax Accountants Bitcoin Accountants Fullstack

Cryptocurrency Tax Accountants Maximised Refund Tax Accounting House 2021

Crypto Bookkeeping Best Practices What You Need To Know Fullstack

Ato Expecting To Collect 3 Billion In Tax Fines From